Current Balance: $29,864.74

Part 3 of this series on creating your plan to pay off you loans will focus on how I used the amortization table I showed you how to create in Part 1 to pay off my initial student loan debt of $153,000 in seven years.

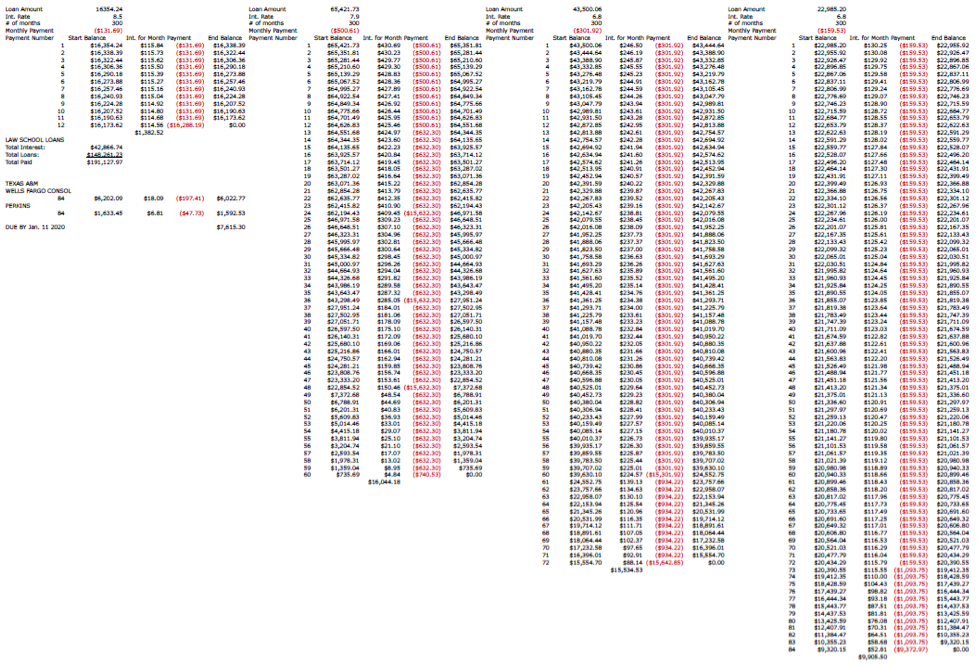

After I created a table for each of my loans, which included 2 consolidated Stafford loans, 2 consolidated Grad PLUS loans, 1 Perkins loan and my undergrad consolidation loan, I played with it for a while to determine how to reach my goal.

Finally, I settled on a repayment plan of saving $800 per month for a total of $9,600 per year based on a budget of two paychecks a month. Remember, I was paid bi-weekly so I received 26 paychecks a year. The other two paychecks (roughly $2,600 each) would almost make up the remainder. So, without further ado, my amortization schedule:

You’ll see in the upper right corner to pay off my $148,261.23 (which did not include the $5,000 Perkins loan) law school loans was still going to cost me $42,866.74 in interest. If I stuck with the minimum payments for 25 years I would pay $179,864.97 in interest!! That blows my mind. If you’re in a similar situation, think about how that affects your ability to save for your retirement, save for your kid’s college, put a down payment on a home or even have a savings account or a rainy day fund.

When you’re creating your amortization table and developing your payoff goal, write down what you would pay in interest if you were to only make the minimum payments. That alone should be your motivation! I didn’t just pay $200,000 in seven years to be student loan free, I saved over $130,000 in interest.

Trust me, you can do this. When I made this table almost six years ago, I’ve never felt so much anxiety. But I developed this plan and I’ve stuck with it. In fact, I should reach my goal a little faster, and you will too.