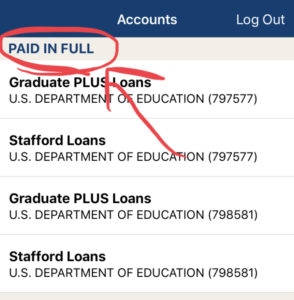

Current Balance:$29,795.11

Lately Navient has come under fire for how it services student loans. In fact, a few states and the Consumer Financial Protection Bureau have filed lawsuits against Navient alleging the company has incorrectly applied payments and failed to notify borrowers of various deadlines or their options when it comes to repayment. Navient’s response to the Bureau’s lawsuit was: “There is no expectation that the servicer will act in the interest of the consumers.” Um…what?!

Navient was not my original loan servicer for my undergrad loan. It was ACS, and I’ve never had any real issues with their service. However, I do find Navient’s practices to be adverse to the borrower. When Navient became my loan servicer, my monthly payment was the same as it was with ACS, $197.41. Then six months later, for no reason or explanation, Navient lowered my payment to $131.09. Most people would be ecstatic their payment went down, and because I mostly subscribe to the avalanche method it didn’t bother me. My Navient loan carries a 3.5% interest rate, so I took the savings and applied it to a higher interest loan.

But why would Navient change my payment? I’m sure you know why. They get more money. In this case, changing my loan payment from $197.41 to $131.09 on a loan balance of $13,348, meant Navient would make an additional $998.42 by extending my loan out an additional four years. To me, this is a shady lending practice. Rather than ask if I wanted my payment to change, Navient unilaterally changed my payment and extended the length of my loan for their own benefit.

Regardless of the outcome of these lawsuits, hopefully Navient and other loan servicers will take ownership of their responsibilities towards borrowers. We will see. Anyone else have good or bad experiences with Navient?