Current balance: $29,764.44

In your journey to pay down your student loans, nothing is sweeter (other than seeing that loan balance go to $0) than getting a raise. But should you allocate all of that additional cash to paying down your student loans? Well….it depends.

Similar on how you may be better suited for using the snowball method versus the avalanche method (see previous post here) on paying down your debt, how you allocate that extra cash could have an effect on being debt free sooner, increase your retirement savings or saving for a much needed vacation. Honestly, it may be beneficial to do all three.

My Father-in-Law taught my wife a great lesson on what she should do when she gets a raise: Put one percent towards your retirement (401K, 403(b), etc.) and use the rest as you see fit. That one percent is not one percent of your raise, but rather one percent of your salary. For example if you make $40K a year and get a three percent raise of $1,200, $400 goes to retirement. This is why my wife contributes 13% to her company retirement plan and is much better off than I am when it comes to saving for retirement. It’s a solid strategy for setting yourself up for future financial success when you retire.

When Warren Buffet was asked what made him one of the richest men in the world he replied, “Three things: Living in America for the great opportunities, having good genes so I lived a long time, and compound interest.” Compound interest is why contributing to your retirement should always be one of your financial strategies, especially if your employer has an employer match program. Let’s say you’re not contributing anything to your company’s 401K and you get a three percent raise, and our company has an employer match program where they match your first three percent of your contribution. If you took your three percent raise and your employer matches your three percent, you just got a six percent raise!! Cha-Ching! In addition to your initial 100 percent return on investment due to your company’s match, that money will grow through compound interest. Double Cha-Ching! That Warren Buffet is a smart man. BONUS TIP: He’s also said most people should put their money in an S&P500 index fund, so if you need help deciding on which fund to use, I’d use your 401K providers S&P500 index fund.

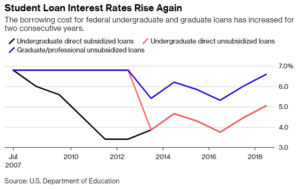

If you’ve already maxed out your employer’s contribution to your 401K, deciding whether to contribute an additional amount to the 401K or paying down your student loans really goes back to the snowball vs. avalanche method. If you subscribe to the snowball method, then paying down your loans is probably your priority. For the avalanche method, you may look at what your highest interest rate is and decide whether or not the interest you could make on your 401K is greater than the highest rate on your loan. Keep in mind, the stock market is not guaranteed. The total return for the S&P500 for 2017 was 21.83%, however ten years earlier in 2008 it was -37%. Yikes!

Finally, about that vacation. Recharging your batteries and spending time with family or friends away from the hustle and bustle of life is always a good thing, and can go a long way in keeping you focused on your journey to pay down your student loans. For me, I’ve used raises and bonuses for all three plus more. You have to decide what is best for you and your financial future.

But hey, congrats on the raise!