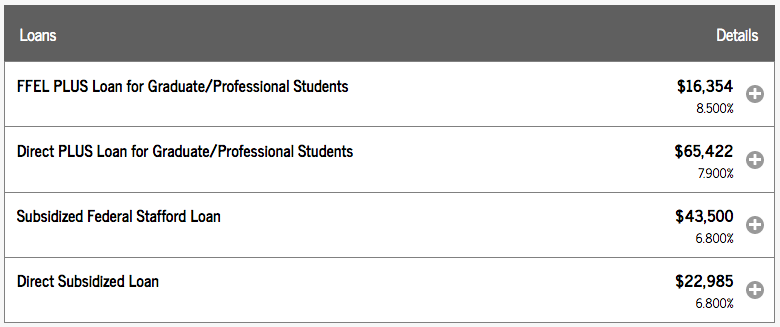

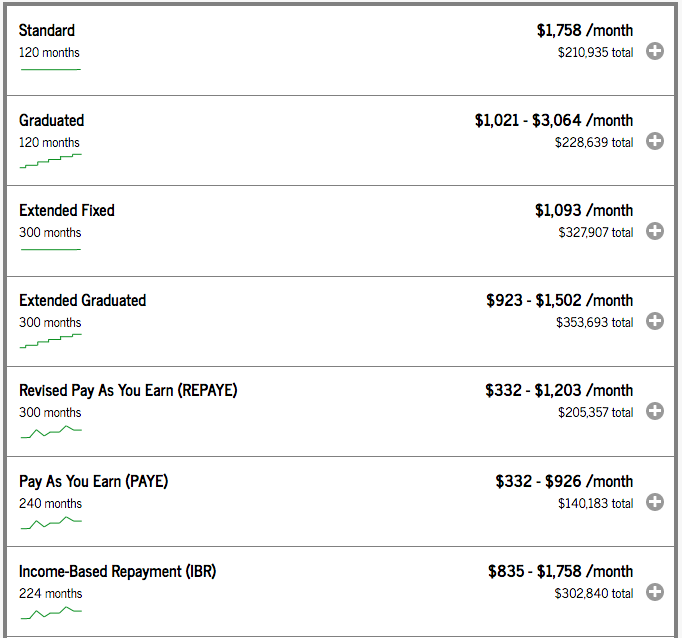

Next, you have the ability to fill in your salary (for income based payment plans), your tax status and a few other options before seeing your payment options:

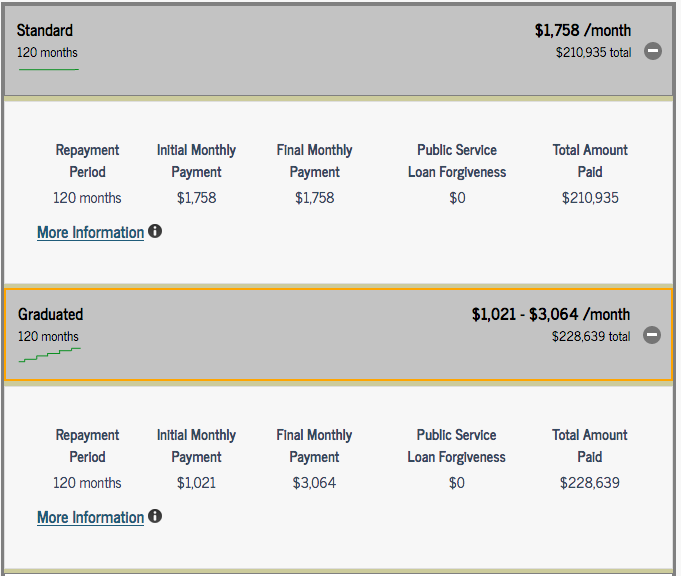

Each payment plan has a drop down box where you can review your initial payment, last payment, whether you qualify for public loan forgiveness, and the total amount you’ll pay over the life of the loan. Each loan also has a “more information” button so you can get a description of the repayment plan.

Getting an idea on what you can afford is the first step in setting a target date to pay off your loans. If you haven’t made a budget, that should be your next step. If you don’t have a job, there are other options like forbearance, but that should be a last resort because you’re only going to incur more interest. More interest equals a longer payoff period.

Reviewing your options is always a good place to start when beginning your student loan repayment journey. Just remember, no matter how high those numbers seem, once you develop a plan for repayment you’ll be surprised at how motivated you’ll be to chip away at your overall balance.